Over the last few years, we’ve noticed more people are beginning to see the value in investing in art, especially in original paintings and limited edition prints. The global art scene is becoming more accessible, and more people are looking to purchase their first original artwork or a limited edition print and begin building their art collections. A fact is that art is not a liquid asset but it can be a very smart investment.

So today, we take a closer look at why original paintings are a good investment and try to point out some examples and some key advice for beginners on how to get started. Keep in mind, there are many more reasons to own a painting, which you will find out through our guides.

Paintings Are A Long-Term Reliable Investment

One of the main reasons why art is a good investment is because it holds its value over time. Unlike stocks or other investments, art does not tend to go up and down in value based on market fluctuations.

The value of an original painting is heavily influenced by its quality and authenticity. Paintings can potentially be a long-term and reliable investment, but it is important to do your research, consult with experts, and consider the risks and uncertainties before making any investment decisions.

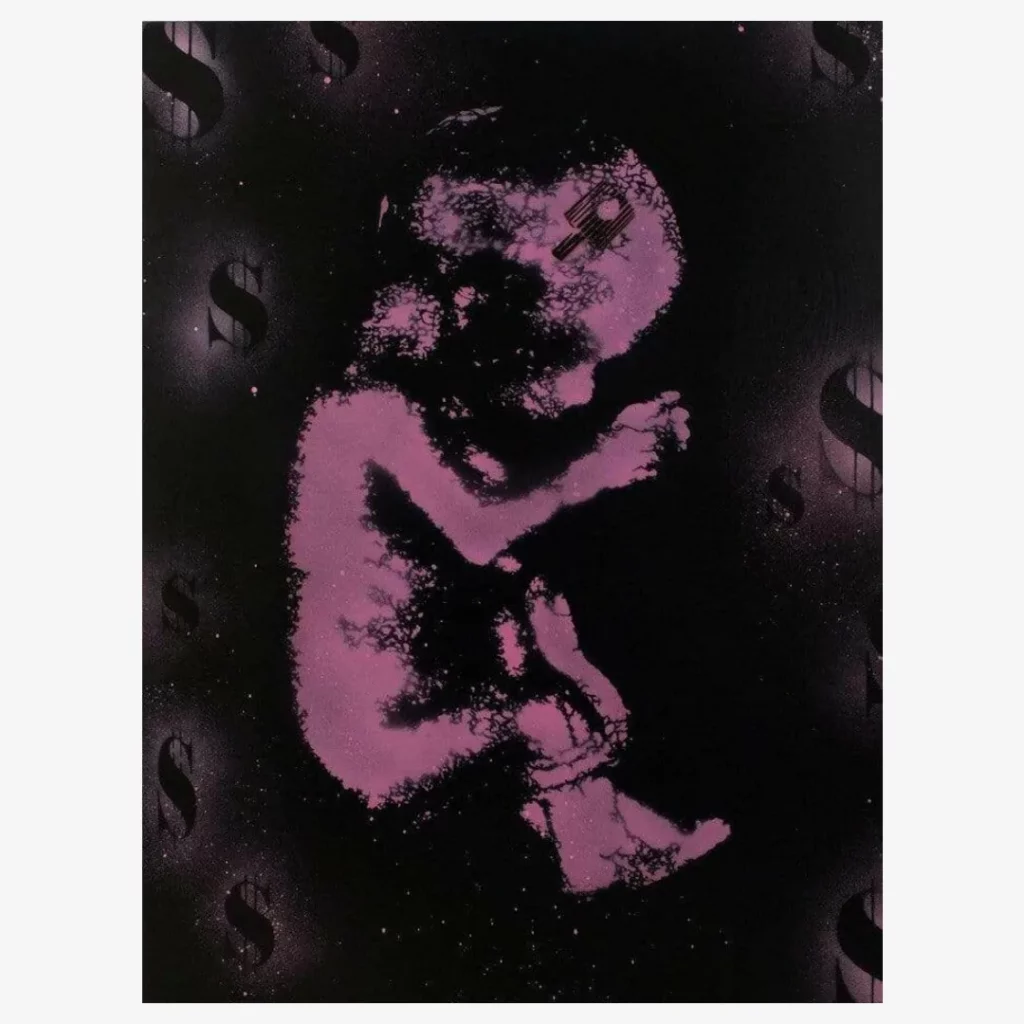

![An original artwork by sheone entitled [METAL SKY] I](https://2b.rocks/wp-content/uploads/2022/12/sheone-metal-sky-i-1024x1024.webp)

Paintings Are Beautiful And Worth Owning

The best reason to invest in original paintings? Art itself is beautiful. The investor can experience joy, peace, serenity, and quiet reflection through art. A painting can enhance the quality of your life, increase satisfaction at home, and give you something to look at or reflect on.

An original painting is worth more than the wealth you can create by investing in it. Good art can make you happy. It is an honor to own art. Art is a rare type of investment that can bring you the same personal rewards as art.

It Has The Power To Grow

It’s a well-known fact that art generally increases in value with age. This is especially true for paintings created by deceased artists. Art’s value tends to increase exponentially after an artist’s death.

Art collectors who wish to maximize the potential growth of their collection can purchase art from a variety of artists. Paintings can appreciate in value over time. This is particularly true for paintings by well-established artists or pieces that gain popularity over time.

It’s A Stable Asset Class

Quite frankly, there’s always a buyer for an art painting and the art market has proven its resilience time and time again, consistently weathering the storms of uncertainty and instability in other markets.

When we look at the long-term data analysis, we can see that when compared to any other asset class, art has the closest correlation to gold; making it a very effective investment choice for maintaining the value of your current wealth as well as offering the potential for future profitability.

Passion And Prestige

At the end of the day, it all comes down to passion and prestige for art. When you invest in original paintings that you’re passionate about, you’re more likely to do your research and learn everything there is to know about it. There’s no doubt that an art painting will as add a sense of luxury and prestige to any space it’s displayed in, making an impression and inferring status to its owner.

Having a collection of art also holds a certain level of prestige that other asset classes do not, a great talking point at dinner parties. Art is reasonably easy to understand as an asset and exists in the portfolios of most successful investors.

Cover image: Uriginal

Leave a Reply